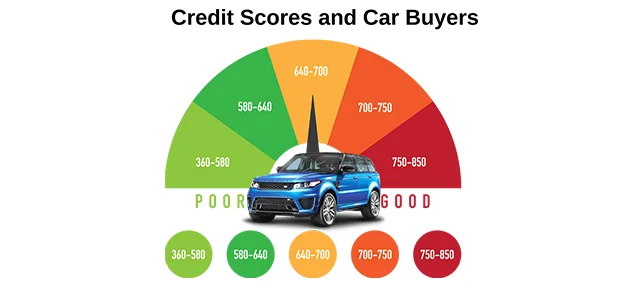

Purchasing your first vehicle is one of life’s most exciting milestones. But if you plan to finance it, your credit score plays a critical role in determining whether you’ll qualify for a loan—and what interest rate you’ll be charged.

What Credit Score Do You Need in South Africa?

Most lenders require a credit score of at least 660 to approve vehicle finance. The higher your score, the better your chances of securing a loan with a lower interest rate and favourable terms. A high score signals that you’re a low-risk borrower. However, if your score is slightly below this threshold, you may still qualify with the right approach.

What If My Credit Score Is Lower Than 660?

You still have options available to boost your chances:

- Increase Your Deposit: Putting down a larger deposit reduces the risk for lenders and improves your chances of approval.

- Co-Signing: Ask a trusted family member or friend with a strong credit score to co-sign your loan.

- Work on Your Score First: Spend 6–12 months reducing debt and paying bills on time to build a stronger credit history before applying.

Other Factors Lenders Consider

Beyond credit score, lenders also assess:

- Employment Stability: Do you have a secure job and steady income?

- Payment History: Have you consistently paid your bills on time?

- Debt-to-Income Ratio: Are your monthly expenses higher than your income? Too much debt can work against you.

How to Improve Your Credit Score

Need to boost your credit score before applying? Here are a few smart steps:

- Start Building Credit: If you don’t have a credit record, consider getting a low-limit credit card or a contract phone. Always pay on time.

- Limit Loan Applications: Avoid applying for multiple loans within a short time span.

- Pay Bills Promptly: Paying on time is essential to maintaining a good credit score.

- Lower Credit Card Balances: Keep balances low and avoid maxing out your cards.

Ultimately, qualifying for car finance depends on your affordability, financial responsibility, and choosing a lender that suits your needs.

Let Us Help You Get Behind the Wheel

Looking to finance your new Honda but not sure where to start? Contact us today and our expert team will guide you every step of the way.